Introduction

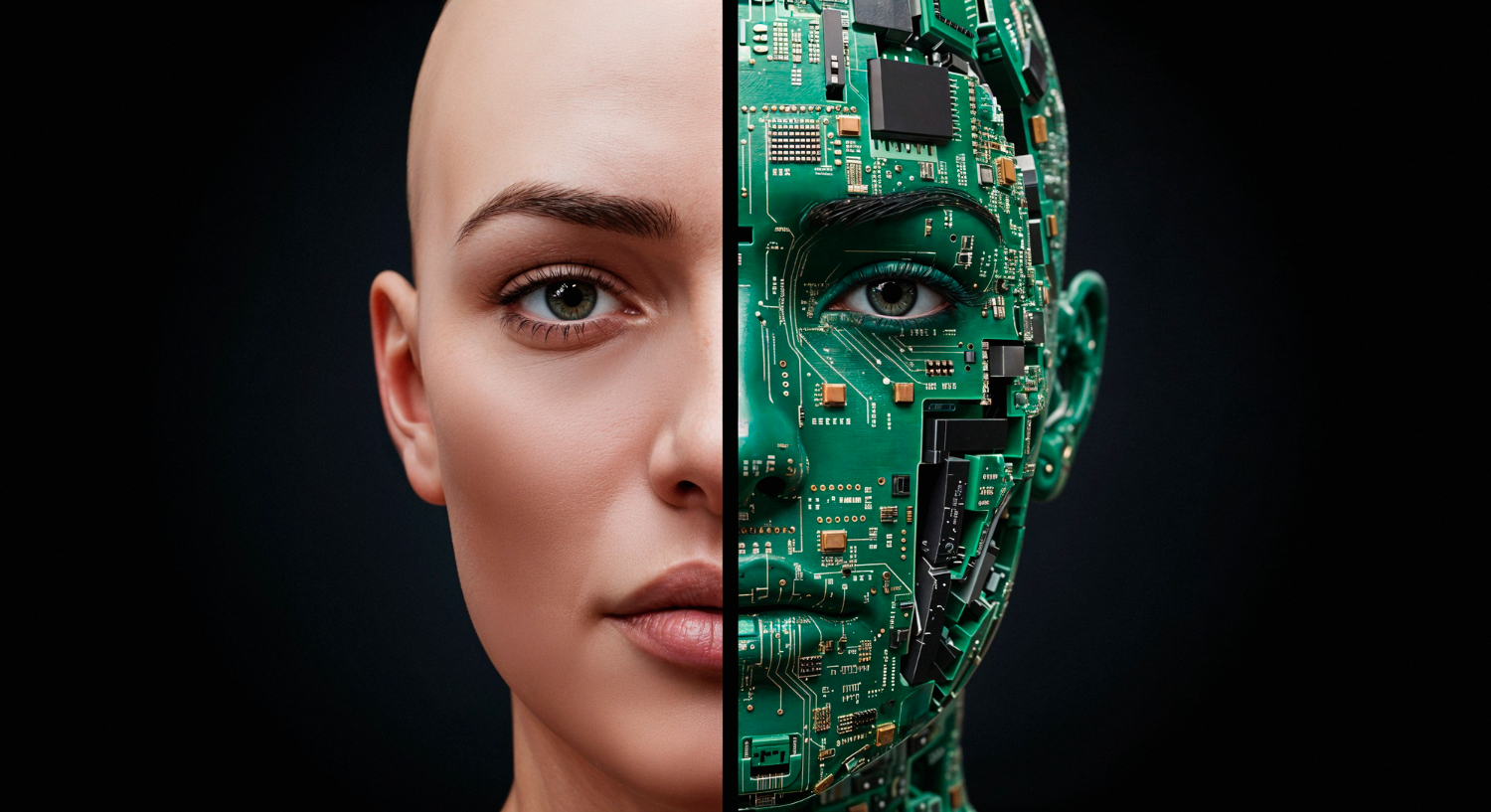

The global market for artificial intelligence (AI) in banking is predicted to increase sixfold, from £4 billion to £64 billion by 2030 (or a 32.6% growth rate for data enthusiasts) (Wood, 2022). According to Forbes, 70% of financial firms are slurping the machine-learning Kool-Aid, predicting cash flow like fortune tellers, tailoring credit scores with Savile Row finesse, and sniffing out fraud faster than a beagle at a sausage factory (Columbus, 2023). But here’s the real magic: AI isn’t replacing us; it’s liberating us. It’s swapping that trusty quill for a self-sharpening gold-ink fountain pen, freeing you to be the financial Picasso you were born to be. So next time someone scoffs at AI in banking, wink and raise your tea. We’re not drowning in algorithms; we’re surfing the wave, building the future of finance that’s as human as it is brilliant. Now, who’s ready to explore something amazing?

Use Cases of AI in the Banking Sector

Artificial Intelligence (AI) is revolutionising the banking and financial services sectors by facilitating process automation, gaining valuable insights, and enhancing customer satisfaction. Here are some of AI’s use cases and applications in banking:

I. Fraud Detection:

We have all had nightmares about data breaches and reputational damage. That is why we created these AI tools: not only to protect your digital safety but also to erect a strong wall of trust around your business. Envision the assurance:

Behavioural Analytics

Your customers’ spending habits become their unique digital fingerprint. Grandma’s sudden Bitcoin spree? AI flags it faster than a bank robber draws his six-shooter.

IoT Watchdogs

Sensors whisper real-time intel about malware incursions or suspicious logins. You shut down threats before they even breach the perimeter.

GPU Muscle

Forget clunky algorithms. Our AI runs on supercharged graphics processing units, crunching mountains of transactions in milliseconds and spotting hidden anomalies like a hawk on Red Bull.

Eagle-Eyed Computer Vision

Facial recognition catches known fraudsters red-handed, while anomaly detection identifies suspicious behaviour in real-time, making digital delinquents feel like reality TV stars in their own heisting show.

II. Risk Management

Gone are the days of hunched accountants poring over spreadsheets. Artificial Intelligence (AI) is a tech-savvy genie in a neural network that can now quickly allay fears—hopefully not too frequently—by uttering the phrase “collateralised debt obligation.” Think of AI as your financial crystal ball, brimming with data and algorithms. It churns through mountains of customer behaviour, market trends, and economic indicators, sniffing out potential risks like a bloodhound on a bad loan trail. Here’s how it works:

Keeping an Eye on Every Rupee

AI can spot anomalies in spending patterns, like a sudden splurge on designer handbags or a flurry of midnight cash withdrawals. This, my friends, is computer vision and behavioural analytics at their finest, keeping fraudsters at bay.

GPU-Accelerated Data Analytics:

Remember when your gut feeling saved you from a dodgy investment? AI does that every day but with the power of a supercomputer. It analyses market trends, scans economic data, and even peeps into global newsfeeds to predict potential risks like a stock market earthquake. GPU-accelerated data analysis and generative AI-powered scenario planning let banks weather any financial storm with a cool head and a full chai pot.

Creditworthiness with a Human Touch

AI analyses your financial history, social media footprint (yes, even your LinkedIn!), and even spending habits to paint a nuanced picture of your creditworthiness, leveraging the power of generative AI. This ensures fair and informed lending decisions, ensuring your loan application is not lost in a pile of paper.

III. Customer Service

As per the data, it is quite evident that a lack of proper customer service might lead customers to switch their banks. In the last year, around 25% of people have switched banks; out of these, 39% did so due to poor customer service)! (Horn, 2023) That’s a scary number, isn’t it? Here’s how AI can help you retain your customer -

Leverage the Power of Data for Personalised Recommendations and Advice

In today’s world, data is power. As B2B or B2C service providers, we must recognise this fact and begin leveraging the data we collect from our customers for long-term benefits. This data can be used to provide personalised recommendations and advice to users and to understand their banking needs. Using sophisticated machine learning algorithms is one of the best ways to uncover the true potential of data. These algorithms crunch numbers in a fraction of time, and woah! You get the insights you need to retain your clients.

AI-Powered Chatbots

We are all familiar with these little buddies that can be easily incorporated into our websites or applications, allowing customers to interact anytime, anywhere. Chatbots can harness the power of Generative AI and increase their efficiency multifold. The chatbots with AI capabilities are a B2B’s best friend when it comes to managing client interaction, freeing up staff members to concentrate more on improving the services!

The Rise of IoT

IoT is revolutionizing the banking sector, making it more efficient, proactive, and personalized than ever before. Smart ATMs are one of the many ways in which banks can not only enhance the customer experience but also enable proactive support and fraud detection. Sensors guide customers and personalize experiences. Imagine walking into a bank and being greeted by a helpful digital assistant on a screen, ready to answer your questions or direct you to the right service!

Feedback and Sentiment Analysis

To customise the services to meet the needs of our users, we must comprehend their precise emotional state. To accurately assess the customer’s needs, attitudes, and emotions, we employ machine learning and natural language processing. This can prove to be a boon for a business-to-consumer industry like banking.

IV Predictive Analytics

Remember when fortune tellers used to make predictions? Well, these days, AI is widely used for that purpose across the industry, with the best-optimized algorithms based on pure mathematics. Here’s how AI and cutting-edge technology can help your firm predict the outcomes of the actions you are planning to take:

Helping Loan Decisions and Credit Scoring

For a human, it can be a tedious task to identify whether it’s risky to lend a certain amount of money to a person or not. However, for AI-powered computers, the process is a matter of a few calculations. How’s that possible? With AI-powered predictive analytics, we can not only evaluate the credit score but also predict the likelihood of loan default.

Tracking Market Trends

The need for market forecasting cannot be underestimated. To rule the market, we must know the market. Predictive analytics can harness the power of AI to accurately predict what trend the market will follow in the upcoming days so that you can prepare well in advance for any situation. Edge Crunches Real-Time IoT Data IoT-enabled Edge computing fuels models for faster, smarter banking decisions. Edge computing brings AI processing closer to the source of the data, at the network edge. This allows for faster analysis of real-time data, enabling banks to make quicker and more informed decisions.

Customer Churn Prediction

It’s very easy for a customer to switch to another bank by seeing any lucrative offer your competitor might provide. At the same time, it’s quite hard for a human to notice the shift in a customer’s behaviour. AI comes to the rescue! We can easily detect a behavioural shift in a client’s spending patterns using predictive modelling powered by AI-powered algorithms and thus determine the churn rate. TechnoLynx has your back with cutting-edge predictive analytics solutions!

V. Loans Underwriting

Yes, we all agree to the fact that loan underwriting is an exhaustive task. From collecting and verifying borrowers’ data to making the big decision - it’s not a cakewalk. But guess what? AI can be the superhero and do all this in a matter of few clicks while you can simply sit back and enjoy your evening tea!

Here’s how:

Document Management

Don’t know whether the documents provided by the loan seeker are genuine or not? Computer Vision is here to help! With AI-powered document management, we can easily manage, access and verify the documents provided. This is done through new-age algorithms including computer vision and cloud computing.

AI-Enabled Decision-Making Systems

Yeah, you heard it right. The computers that laboured under our commands in the past are now competent enough to assist us in making difficult choices. AI can identify both positive and negative patterns through the use of the aforementioned use cases, such as credit scoring, risk assessment, and predictive analytics. As a result, it can assist in the thoughtful underwriting of loans by identifying patterns.

Reduce Processing Time

With AI-enabled loan underwriting, the processing time for loans can be reduced to up to 30-60 seconds! Thanks to the fast decision-making, proper management of documents and digital transaction systems. Furthermore, machine learning underwriting can determine creditworthiness and accurately estimate risk, which will speed up loan approval and reduce processing time.

Check out the article Can You Get A Loan With No Credit? Everything You Need To Know, written by Benjamin Locke for a comprehensive overiview on the topic!

Benefits of Leveraging the Power of AI in the Banking Sector

- Security Sentinel: Forget about cumbersome firewalls. AI scans data oceans like X-ray vision, nabbing hidden fraudsters before they can hatch financial fiascos. It’s a superhero safeguarding your bank’s future.

- Treasure Trove Unlocking: Buried insights, once hidden, are cracked open by AI. Think treasure maps, revealing personalized services and smarter investments. AI helps you capitalize on data’s hidden gems.

- Efficiency Ninja: Double transaction volume without raising costs? Not a fantasy with AI. Studies show up to 5X efficiency boosts (Schmelzer, 2023), turning your bank from sluggish tortoise to nimble ninja.

- Happy Customer Haven: AI is not limited to spreadsheets. Banking professionals and customers alike benefit from AI, according to nearly half of finance professionals who report enhanced customer experiences.

- Bottom Line Bounty: Business Insider estimates banks will save $447 billion in 2023 alone (Voutik, 2023) thanks to AI. Get started and see how each AI wave improves your financial future.

Challenges of Using AI in this Field

The Data Dilemma

High-quality data is required, but it is difficult to come by. This can lead to unfair results containing lots of errors. Also, It is quite difficult to strike a balance between innovation, security and morality.

Tech & Infrastructure:

Finding AI wizards is difficult, leaving banks talent-starved. Thus, it is crucial to demystify AI’s black box decisions to build trust and avoid regulatory issues.

Organizational Hurdles:

Changing gears or overcoming resistance from teams that are stuck in their ways is not an easy task. Ensuring AI abides by fairness, transparency, and societal impact is necessary while avoiding regulatory pitfalls in an ever-changing landscape. Several challenges are associated with utilising the AI treasure trove for your company, but with foresight and courage, banks can emerge victorious, paving the way for an intelligent and innovative future.

What can we, as a software company, offer you?

- AI Consulting: Our experts work with yours to navigate the fascinating world of AI. We don’t just point the way, we walk it with you.

- GPU Acceleration: Consider AI as a spacecraft. TechnoLynx gives it a GPU boost, ensuring those intricate algorithms run smoothly and process data at breakneck speed.

- Visionary Solutions: Our Computer Vision sees more than eyes can. It adds intelligence to your security and services by detecting fraud and using facial recognition.

- Creative Spark: Need to personalize marketing or generate unique content? Your creative partner is generative AI. With TechnoLynx, you can create experiences that truly connect.

- Edge Intelligence: Not all data is helpful. IoT edge computing places processing power where needed for quick responses and smooth operations.

With TechnoLynx as your partner, AI is not just a buzzword; it is your superpower. Together, we can build a bank that is as safe, intelligent, and personalised as your clients deserve.

Conclusion

AI is a current banking revolution, not a future vision. Banks can shape a future where finance is smarter, smoother, and specifically tailored to everyone by embracing its potential and using it to unlock efficiency, forge security shields, and build long-term customer relationships. Surf on the AI wave with TechnoLynx, and watch your bank rise from the tide, stronger and brighter than ever before!

Sources

Columbus, L. (2023). The state of AI adoption in financial services, Forbes.

Horn, K. (2023). Customers will switch banks due to poor service - here’s how AI can help, Salesforce. (Accessed: 10 January 2024).

Schmelzer, R. (2023). The top 5 benefits of AI in banking and finance, Enterprise AI. Tech Target.

Voutik, L. (2023). AI in banking: How banks use ai, Quytech Blog. (Accessed: 10 January 2024).

Wood, L. (2022). The global AI in Banking Market will grow to $64.03 billion by 2030, at a CAGR of 32.6% during 2021-2030 - researchandmarkets.com, Business Wire. (Accessed: 10 January 2024