Fraud Detector Audit (Under NDA)

TechnoLynx was brought on board to help tackle challenges with an existing fraud detector at a multi-national, medium-sized company, specifically very rare outlier fraud cases with too little data to train the system to recognise them.

The Challenge

These outliers occurred so infrequently that there was not enough data to train the system to recognise them, and missing them could have a substantial impact on operations, customer trust, and financial stability.

Rare outliers, limited training data

These outlier cases occurred so infrequently that there wasn’t enough data to effectively train the system to recognise them.

High-impact failure modes

These rare cases could have a substantial impact on the company’s operations if not detected early, and detecting fraud is crucial for maintaining customer trust and safeguarding financial stability.

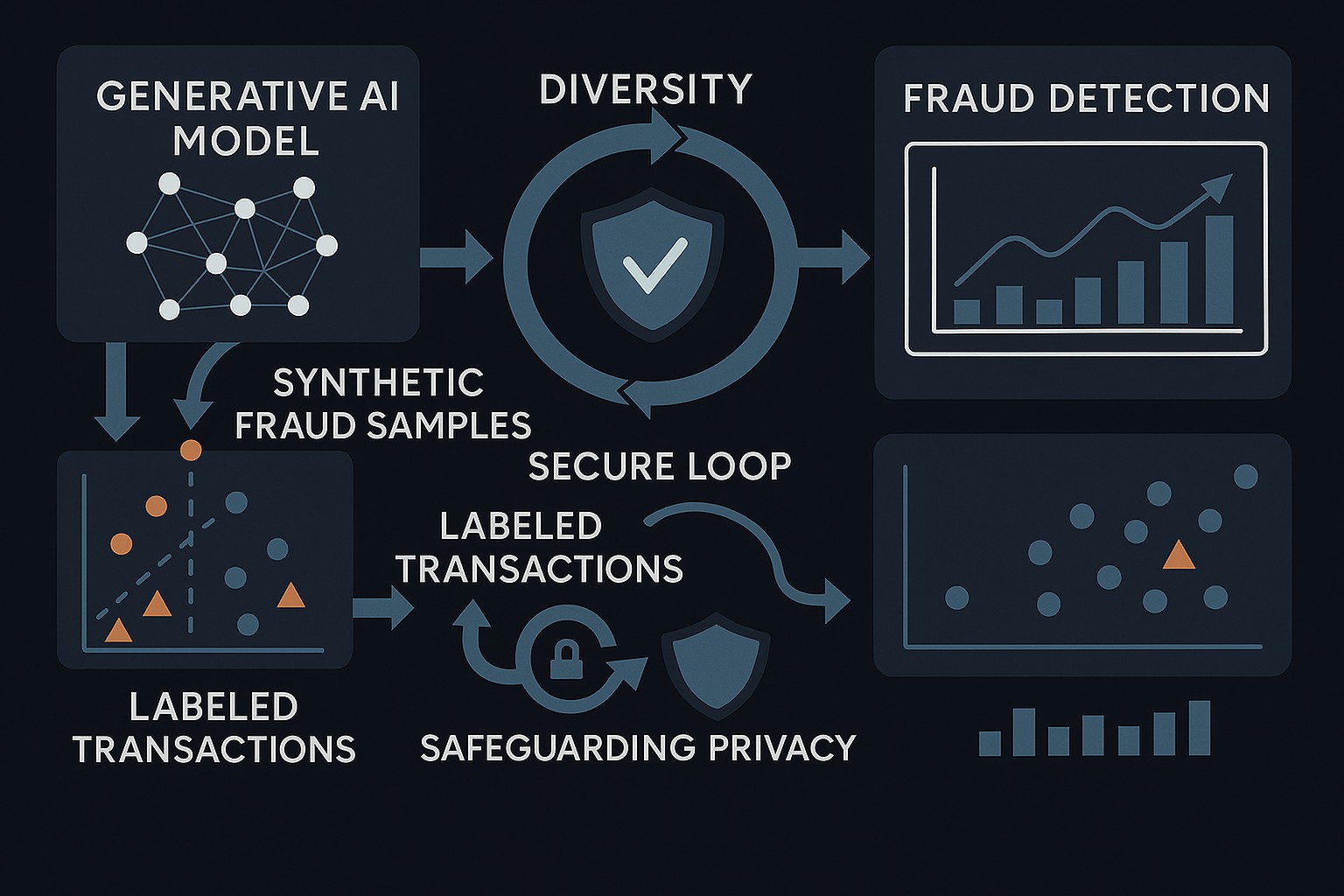

Synthetic data as a path to resilience

The client’s initial hypothesis was to generate artificial samples similar to known problematic cases and add them to training to improve resilience.

Image credits: Freepik.

Project Timeline

From synthetic sample generation to a thorough review of the data acquisition pipeline and accuracy metrics

Outlier Framing

Identified a set of very rare outlier fraud cases that posed a serious threat, with too little data to effectively train the system to recognise them.

Built a system intended to generate new synthetic samples resembling rare outlier fraud cases using generative model techniques.

Synthetic Generation

Targeted Augmentation

Pivoted to augmenting existing correct/incorrect samples with minor changes designed to fail or pass the current fraud detector, exposing broader resilience gaps.

Tightened collaboration with the client’s internal team and conducted a thorough review of the data acquisition pipeline and accuracy metrics.

Data & Metrics Audit

Recommendations & Adoption

Delivered practical recommendations to improve resilience and measurement; the client implemented them and adopted best practices at a process level.

The Solution

We began within the client’s initial scope: generate synthetic samples resembling rare outlier fraud cases. When the generated samples did not capture the specific fraudulent properties of concern, we pivoted to targeted augmentation and then broadened into a thorough review of the data acquisition pipeline and accuracy metrics.

Built a synthetic-sample generation system using generative model techniques. In practice, generated samples did not exhibit the specific fraudulent properties the client was most concerned about.

Developed a system to augment existing correct/incorrect samples with small changes designed to fail or pass the current fraud detector, revealing more general resilience issues beyond the originally known outliers.

Conducted a thorough review of the client’s data acquisition pipeline and accuracy metrics, then delivered recommendations aimed at improving the overall resilience of the fraud detection system.

Technical Specifications

The Outcome

The project concluded with a set of final recommendations that the client implemented, introducing a more dependable way to measure fraud model accuracy.

Reported after implementing improved measurement methods and project recommendations.

Key Achievements

Delivered final recommendations that the client implemented to improve overall resilience

Introduced a more dependable method for measuring the fraud model’s accuracy

Reported accuracy improvement of over 20% after adopting the new methods and processes

Improved identification of fraudulent transactions, including rare outlier cases

Best-practice recommendations were adopted at a process level and benefited other client projects

Improved the client’s ability to monitor and manage risks associated with fraudulent transactions

Want to Improve Fraud Detection Resilience?

Let’s discuss how stronger data pipelines, better accuracy measurement, and ML-driven approaches can reduce risk from rare outlier cases.